Jump to:

- Why don't more small grocers accept SNAP?

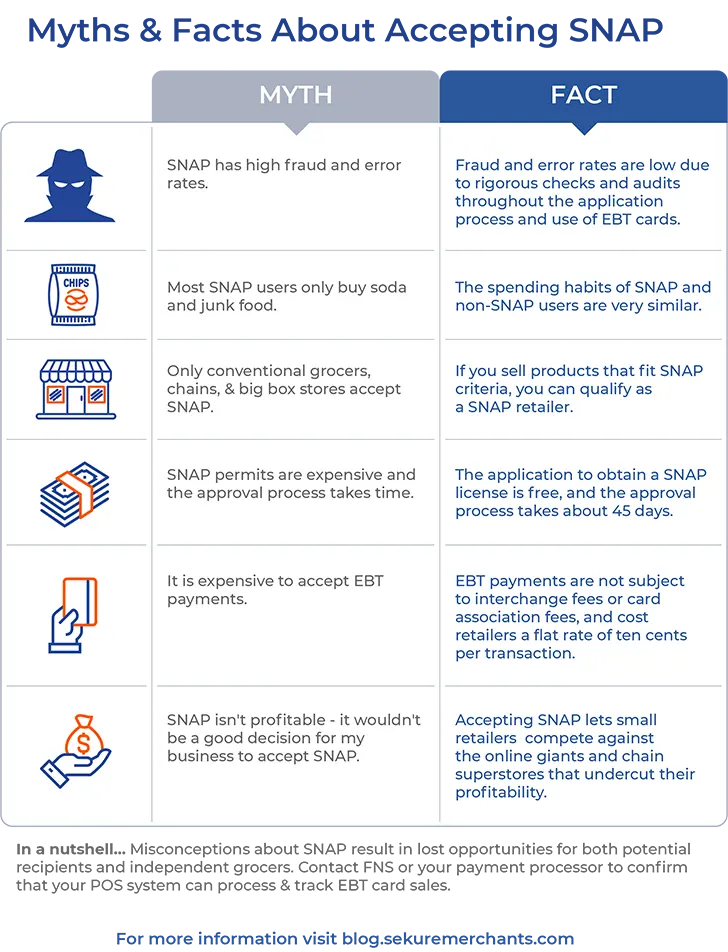

- Myth SNAP has high fraud and error rates

- Myth Most SNAP users buy soda and junk food

- Myth I have to be a conventional grocer, chain, or big box store to accept SNAP

- Myth SNAP permits are expensive and the approval process takes time

- Myth It is expensive to accept EBT payments

- Myth SNAP isn't profitable - it wouldn't be a good decision for my business to accept SNAP

- Final thoughts

Independent grocers are significant, but under-recognized, contributors to the health of America’s economy. They generate over 1 million jobs and gross billions of dollars in wages and tax revenues and are responsible for 1.2% of the national GDP.

Why don't more small grocers accept SNAP?

In addition, these small businesses are also responsible for job creation in adjacent industries from agriculture to manufacturing and transportation. Despite this, the health of the independent grocery market is under threat from chains and online competition.

A market report published by National Grocers of America (NGA) showed that, in 2020, consumers turned to online shopping platforms to satisfy all of their needs, including groceries. This led to a staggering 54% increase in online grocery sales. At the same time that COVID-19 lockdowns resulted in such great growth in online sales, the number of Americans facing food insecurity increased sharply, as well.

Supply chain issues and staffing shortages caused the price of groceries across the country to rise. With schools closed, and many Americans laid off or working drastically lower hours, the number of households experiencing food hardships increased and continue to increase.

The Center on Budget and Policy Priorities reported that food prices broke a 50-year record monthly rise in April. Programs like the Supplemental Nutritional Assistance Program (SNAP) and articles outlined in the American Rescue Plan that will alleviate food insecurity for Americans will be instrumental in bringing the American economy back online and at full force.

Even as small grocers streamline their online shopping platforms, large players like Amazon have the financial and technical capacity to innovate faster than their local, independent competition. One way that independent grocers can stay competitive and better serve their operating communities is by participating in SNAP.

According to the NGA, “SNAP purchase activity at retail stores was responsible for generating more than $1.0 billion for 2020 federal tax receipts”. Of that revenue, small grocers make up only a slim portion, with superstores and online grocers taking the bulk of the pie. When small, local grocery stores accept SNAP in their stores and online, they are better able to compete against the online giants and chain superstores that undercut their profitability.

The reason that many smaller grocery retailers do not accept SNAP has to do with confusion about the program, recipients, and which types of retailers can qualify.

Myth 1: SNAP has high fraud and error rates

Fact: Contrary to public opinion, there’s very little fraud that takes place within the SNAP program. Due to the rigorous application process, routine governmental checks, and use of Electronic Benefits Transfer (EBT) cards, fraud is low. Moreover, with the use of EBT cards, the history of transactions is recorded so that tracing any suspicious purchases is easy.

Since the program’s inception, SNAP has undergone rigorous reviews and quality assurance checks to optimize accessibility for both recipients and retailers.

Myth 2: Most SNAP users buy soda and junk food

Fact: There’s very little difference in spending habits between SNAP and non-SNAP users. This myth might come from the fact that there are food deserts in inner-city and low-income areas, as a result, people have no choice but to buy food - healthy and junk alike - from convenience stores.

The reality is that food insecurity is not confined to low-income, urban residential areas but is an issue that impacts families in every neighborhood across the country.

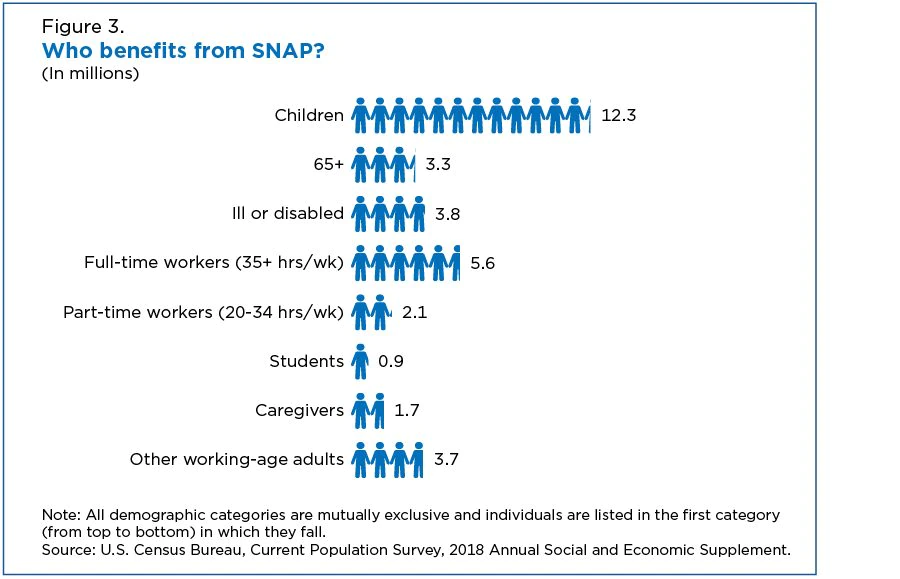

The USDA reports that 41,845,169 Americans are receiving SNAP benefits which allow them to afford healthy food options more easily.

According to Census data, in 2018 the majority of SNAP recipients were households with children. Other recipients include the elderly, disabled, and their caretakers.

SNAP recipients by and large use their benefits to purchase healthy, nutritious food for themselves and their loved ones that they otherwise would not be able to afford easily.

Myth 3: I have to be a conventional grocer, chain, or big box store to accept SNAP

Fact: Not at all. Any store that fulfills SNAP criteria can apply.

Stores must EITHER sell staple food items, from 4 categories, namely:

- Fruits & vegetables

- Dairy products

- Meat, poultry, and/or fish

- Bread and cereals

OR receive 50% or more of their total gross retail sales from the sale of staple foods. This means that specialty food stores like bakeries, butchers, greengrocers, and fishmongers can also be eligible.

In other words, SNAP isn’t just for big box or chain grocery stores - independent grocers, convenience stores, farm stands, farmer’s markets, specialty stores, and consumer-supported agriculture (CSAs) are eligible to apply.

In a recent article, the National Grocers Association summarized the role of independent grocers in making SNAP successful: "Independent community grocers are unique in that they are often located in rural and hard-to-reach areas, many of which would be classified as food deserts if the stores were not present. Independents can reach communities that big-box stores do not find profitable to serve"

Watch this 11-minute video about SNAP requirements for retailers by USDA if you want to learn more.

Myth 4: SNAP permits are expensive and the approval process takes time

Fact: The application to obtain a SNAP permit is free. The application can be completed online, where you will be required to submit various information and documentation about your business. The approval time varies, but on average takes approximately 45 days.

Myth 5: It is expensive to accept EBT payments

Fact: Once your SNAP permit is approved, you’ll need to have the right equipment to accept Electronic Benefits Transfer (EBT) cards.

SNAP recipients use EBT cards to claim their benefits and pay for SNAP-approved purchases. They are payment cards with magstripes and operate similarly to credit and debit cards. You’ll need to have a terminal with a keypad so that recipients can input their PINs. If you already have the hardware, it will need to be programmed to accept EBT cards.

It’s important to check with your payment processor about processing rates for EBT cards. Some businesses qualify for free processing equipment from FNS which can make accepting SNAP even more profitable for independent grocers.

Sekure offers POS solutions for independent grocers with functionalities that facilitate SNAP and EBT payment acceptance. Our payment specialists can create a right-sized POS system that will enable you to accept EBT payments and grow your business.

Myth 6: SNAP isn't profitable - it wouldn't be a good decision for my business to accept SNAP

Fact: According to the NGA, “SNAP purchase activity at retail stores was responsible for generating more than $1.0 billion for 2020 federal tax receipts”. Of that revenue, small grocers make up only a slim portion, with superstores and online grocers taking the bulk of the pie. When small, local grocery stores accept SNAP in their stores and online, they are better able to compete against the online giants and chain superstores that undercut their profitability.

For retailers, EBT purchases result in higher profit margins for retailers. Since they are issued by the government rather than a credit card issuing bank, EBT purchases are not subject to interchange fees, though they are still subject to processing fees.

Since SNAP is not yet widely available online or via grocery delivery - being able to accept SNAP at the Point of Sale represents a massive opportunity for independent grocers to grow their local customer base and ensure SNAP recipients in your community are able to provide wholesome, healthy meals for their families.

Final thoughts

Misconceptions about SNAP result in lost opportunities for both potential recipients and independent grocers. Even though the application process for SNAP is relatively straightforward, it's best to contact FNS or your payment processor to make sure that you have the right POS system to easily accept EBT cards & track sales in case of a potential audit.

Categories