Offering a variety of convenient payment options for customers has never been easier — and for companies, large and small business alike, these options have never been more accessible.

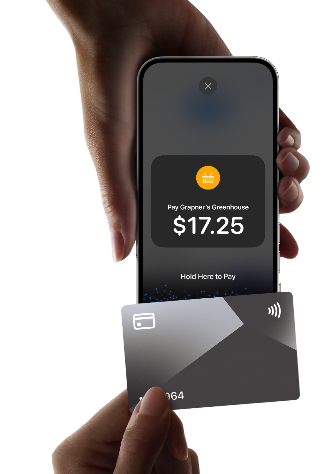

Mobile credit card machines are one such technology that has contributed to the ongoing changes in how consumers transact. With seamlessness and security as the technology’s key objectives, businesses are increasingly relying on mobile credit card machines to meet modern and growing customer expectations.

How do mobile credit card machines work, exactly? What are the various use cases, and which is the best mobile credit card reader for my business? Read on as we answer these questions and more.

Mobile credit card readers: Meeting modern expectations

Mobile card readers allow businesses to process payments anywhere, anytime. By integrating with your smartphone, tablet or desktop, mobile credit card readers transform these mobile devices into fully functioning POS systems.

Accept payments directly on your iPhone!

Learn more50% of customers consider a seamless transaction experience central to their decision-making on where to shop. Study after study suggests that retailers who adopt line-busting POS strategies are better positioned to retain customers and drive sales.

Mobile credit card readers facilitate line busting — you can adjust your business’ transaction experience to the needs of your customers.

But that’s not all; mobile credit card readers also allow you to:

- Accept fast mobile payments, anytime: Whether you sell at a farmers market, from your garage, or in an establishment, you can rely on mobile credit card machines to provide your customers with a seamless transaction experience.

- Increase sales with convenient card payments: A seamless transaction experience translates to increased sales. The opposite is also true — failing to offer a variety of payment options can lead to missed opportunities and decreased customer satisfaction. With mobile card readers, businesses can accept multiple contactless payment methods from any location.

- Adopt this technology with ease: It’s easy to get started with mobile POS technology. And, by partnering with Sekure Payment Experts, we ensure that you can access this technology at low, predictable rates.

Payanywhere’s mobile credit card machine is a 3-in-1 solution that allows you to accept multiple payment types: EMV chip cards, Magstripe credit cards, contactless mobile payments like Apple Pay and Samsung Pay, mobile wallets and others. It’s minimalist enough to fit in your pocket, yet sophisticated enough to offer your customers a frictionless experience.

You can learn more about Payanywhere’s mobile card reader here.

Accept payments from anywhere: Mobile card reader use cases

Here are three common use cases for mobile credit card machines. For more information on the reasons why businesses are adopting portable credit card processing, click here.

- In or around your store: Mobile credit card machines enable staff to assist customers wherever they are within the store. For line busting in particular, this makes it easier to complete transactions on the sales floor without the need for customers to queue at your checkout counters.

- Farmers market: Mobile credit card payment solutions allow vendors to set up a point of sale quickly without extensive equipment — a must for farmers market merchants. They can easily accept contactless payment amid the bustling environment, ensuring that customers enjoy a smooth checkout experience — even in an outdoor setting.

- Delivery: During delivery and while on the go more generally, mobile credit card payment solutions allow for a quick and secure payment.

Beyond these three use cases, mobile credit card processing offers additional flexibility and convenience across various other business scenarios. They are especially valuable for temporary setups such as pop-up shops, outdoor events and trade shows where traditional POS systems prove to be impractical. Moreover, they are beneficial for service-based businesses — home repairs, personal training and others — where services are rendered at the client's location.

How secure are mobile credit card machines?

When choosing the best portable credit card reader for your business, considering security is fundamental. Ensuring transaction security isn’t an added benefit as much as it is a necessity. Increasingly stringent regulations require businesses to adhere to robust data protection standards to safeguard customer information during and after transactions.

For businesses, this means adopting technologies that come embedded with the best and latest security protocols. Here’s how Payanywhere’s mobile credit card reader facilitates secure credit card payments:

EMV technology: EMV (Europay, Mastercard and Visa) technology utilizes a small, integrated circuit or chip embedded in the card that generates a unique transaction code each time the card is used. This unique code cannot be reused, which significantly reduces the risk of counterfeit fraud compared to the static data stored on magnetic stripes.

Encryption: This involves encoding card data into a secure format that can only be decoded with a specific decryption key. In the case of credit card transactions, data is encrypted the moment it is read by the card reader — ensuring that it remains secure as it travels through the payment processing network.

Tokenization: Tokenization replaces sensitive card details with a non-sensitive equivalent, known as a token, which has no extrinsic or exploitable meaning or value. Tokens are used within the payment processing network to ensure that actual card details are not exposed during the transaction process or stored on merchant systems.

Bluetooth encryption: Secure Bluetooth connections use encryption and authentication protocols such as Secure Simple Pairing (SSP) with Elliptic Curve Diffie-Hellman (ECDH) for key agreement and AES-128 for data encryption. These protocols protect data transmission between the card reader and the mobile device against interception and unauthorized access.

Ultimately, it’s by adopting Payanywhere’s mobile credit card processing solution that businesses can offer their customers a frictionless transaction experience at no expense to their security posture.

Adopt a mobile credit card reader at low, predictable rates

Whatever your business needs are, mobile credit card readers can cater to them — offering seamlessness, flexibility and security.

With Payanywhere's mobile payment solution, gaining access to portable credit card technology is easy. And with Sekure, you can gain the lowest rates available. We work with you to obtain a predictable payment plan based on your specific business needs — plus, we provide free hardware.

Accept payments from anywhere, with Payanywhere.

Fill out the below form to receive a custom quote.

Categories