What is a virtual terminal?

A virtual terminal is an online tool that lets you take credit card payments without a reader. Just enter your customer’s payment details into a secure form on your computer or phone to process the transaction.

1. Log in to the virtual terminal

Access your secure web-based terminal from any computer, tablet, or phone. No special hardware is required—just your login details.

2. Enter customer payment details

Type in the card number, expiration date, CVV, and billing information into the secure form.

3. Process and accept the payment

Submit the transaction with a single click. The payment is processed instantly, and you’ll receive confirmation on-screen.

Unlock the power of the virtual terminal

A virtual terminal isn’t just a backup solution—it’s a smarter, more flexible way to accept payments. Whether you run a service-based business, take orders over the phone, or simply want a lightweight option for card payments, virtual terminals give you the freedom to manage transactions without relying on physical hardware.

Remote flexibility

Take payments from anywhere. Perfect for remote teams, phone orders, and businesses without a physical storefront.

- Accept payments by phone, email, or online.

- Serve customers in different locations.

- Process transactions while working from home or on the go.

Lower costs

Save money by skipping bulky POS hardware and ongoing maintenance fees.

- No need to purchase or replace expensive equipment.

- Simple setup—just log in from your phone, computer, or tablet.

- Lower overhead costs, especially for small or seasonal businesses.

Enhanced security

Every transaction is PCI-compliant with advanced encryption and tokenization.

- Protect sensitive customer data from fraud and breaches.

- Transactions are secured in real-time with industry-standard protocols.

- Build customer trust by offering safe, reliable payments.

Operational efficiency

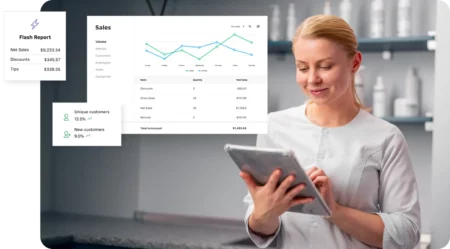

Simplify payments and reduce errors with an intuitive interface.

- Enter card details quickly with minimal steps.

- Built-in reporting tools help reconcile payments faster.

- Reduce manual errors and speed up your daily workflow.

Virtual terminals at work

Virtual terminals are designed to fit the way modern businesses work. Whether you’re handling payments remotely, on the go, or as a backup option, they give you the flexibility and reliability you need.

Over-the-phone payments

From service providers taking client payments to contractors invoicing on the go, a virtual terminal makes phone payments simple and secure. Just enter the customer’s card details into the system, and you’re paid without needing a card reader.

Businesses on the go

If you’re delivering products, offering mobile services, or working outside a traditional storefront, a virtual terminal lets you accept payments from anywhere. No bulky hardware required—just your phone, laptop, or tablet.

A reliable Plan B

Even the best card readers or networks can go down. With a virtual terminal as your backup, you can keep accepting payments without interruptions, avoiding costly downtime and keeping customers happy.

Take your virtual terminal further

A virtual terminal is incredibly versatile on its own, but pairing it with other payment solutions gives your business even more flexibility.

Pay for what you need and never what you don’t

POS hardware rentals can be expensive. That’s why our Payment Experts help you save on both POS software and equipment.

In most cases, our Payment Experts make sure your payment processor provides hardware free of charge, so you only pay for what your business actually needs.

Plus, with our Rate Sekurity Guarantee®, you can be confident you’re always getting the best possible deal—no surprises, no hidden costs.