Jump to:

- What are credit card chargebacks?

- When do customers request chargebacks?

- What is the credit card chargeback process?

- The consequences of credit card chargebacks

- Credit card chargebacks: Your rights as a merchant

- Addressing chargeback FAQs

- Working with a leading payment service provider: Prevent chargebacks with expert advice

Online transactions are happening every millisecond, so it's essential for both shoppers and businesses to get a handle on credit card chargebacks. They serve as a safety net for buyers but can be a significant headache for businesses. Whether you're a seasoned merchant or just dipping your toes into eCommerce, knowing how chargebacks work, why they happen, and how to manage them can save you more than just time and money, but also a lot of frustration.

Read on for a breakdown of everything you need to know about chargebacks and how to prevent them in the long run.

What are credit card chargebacks?

Chargebacks — also known as reversals — happen when funds are returned to the purchaser after a transaction, especially in card-not-present (CNP) situations. They’re essentially a consumer protection feature under Regulation Z of the Truth in Lending Act, where debit cardholders are afforded the same rights under Regulation E of the Electronic Fund Transfer Act.

Here’s the key difference: A chargeback is not a refund. Refunds are voluntary reimbursements that merchants give to customers. Chargebacks, on the other hand, are disputes initiated by the purchaser through their issuing bank (i.e., the bank that issues the credit card) and they’re not optional. With refunds, the merchant gives the money back directly. But with chargebacks, the card issuer refunds the buyer first and then pursues the merchant for reimbursement.

The buyer typically sees their money returned within about 10 days. Meanwhile, the bank starts a chargeback dispute with the merchant. Regardless of the outcome, merchants often end up paying a chargeback fee to cover the credit card processor’s investigation costs.

What are credit card chargebacks?

Find out the dos and don’ts of how to navigate chargebacks for your business.

When do customers request chargebacks?

Many chargebacks result from legitimate criminal fraud. Bad people steal credit card numbers and use them to purchase goods and services. A fraudulent charge has likely happened to you — you check your credit card statement only to notice a $200 charge from a makeup store in Boise when (a) you’ve never been to Idaho and (b) you don’t wear makeup.

Let’s take a closer look at other situations that result in chargebacks:

Accidental fraud

This kind of chargeback fraud happens when a customer makes a purchase but doesn’t recognize the merchant’s name on the bank statement. Issuing banks are usually good at screening for this kind of “fraud” and help cardholders recognize charges — but not always.

Friendly fraud

This type of chargeback occurs when customers make a legitimate purchase, receive the goods, and then dispute the charge. These fraudsters abuse merchants’ policies to keep products instead of returning them. It’s a growing issue—annual losses from chargeback fraud are expected to reach $28.1 billion by 2026, a 40% increase from 2023.

Legitimate disputes

Customers often start genuine disputes when they run into issues with a merchant’s products or services. Here are a few examples:

- Duplicate charges

- Misplaced orders and processing/shipping errors

- Damaged items

- Canceled subscriptions (e.g., a customer cancels a subscription but is charged anyway)

If you want to avoid the chargeback process, you’ve got to be all in on fraud prevention. Think about:

- Verifying the customer’s billing address

- Tracking shipments and getting signatures on delivery

- Keeping an eye on — or even banning — frequent chargeback initiators

Additional best practices—such as clear return policies, accurate product descriptions, and responsive customer communication—also play a key role in reducing chargeback risk. These measures are part of a broader strategy for effectively navigating chargebacks in retail.

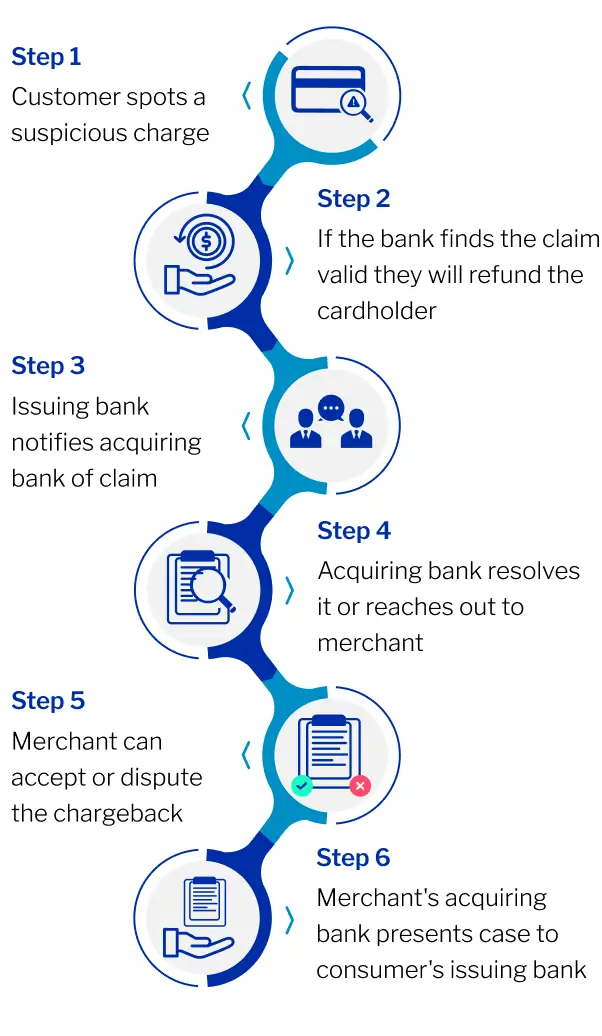

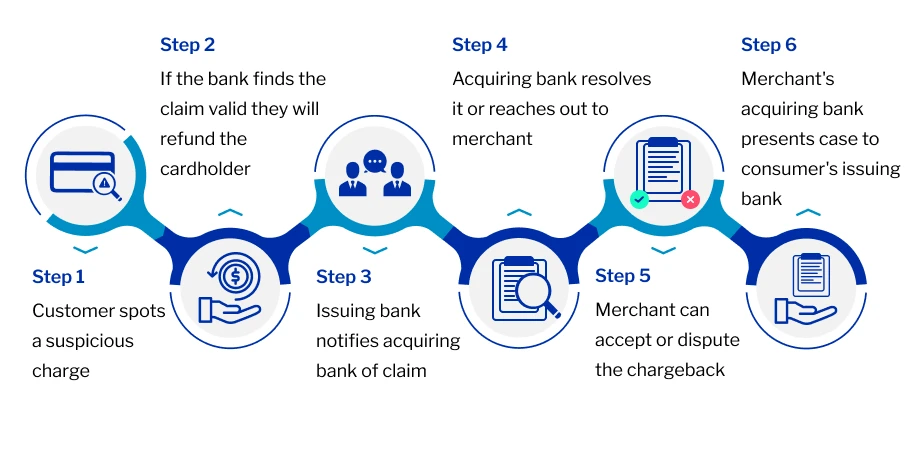

What is the credit card chargeback process?

Here’s a quick rundown on how chargebacks are handled:

- The customer spots a suspicious or unfamiliar charge on their credit card statement and contacts their card provider to file a chargeback claim.

- If the bank finds the claim valid, the credit card issuer assigns a code to the claim and refunds the cardholder. While some claims get denied, most are approved since chargebacks are designed to protect consumers, after all.

- The issuing bank notifies the acquiring bank (the one handling payments for the merchant) of the claim.

- The acquiring bank takes a look and either resolves it or reaches out to the merchant.

- If the chargeback is forwarded to the merchant, they can either accept or dispute it as an illegitimate chargeback. If they choose to contest, they’ll need to provide proof that the card transaction was legitimate.

- The merchant’s acquiring bank then presents the case to the consumer’s issuing bank. If the issuing bank accepts the merchant’s case, the funds are returned to the merchant, and the charge stands. If they side with the customer, the refund sticks.

The consequences of credit card chargebacks

Even if you fight a chargeback and win, you’re probably still on the hook for a fee. So, what’s the best strategy? Do whatever you can to prevent chargebacks in the first place. Here’s a look at the direct and indirect costs that come with chargebacks:

- Opportunity cost

- Cost of the forced refund

- Lost inventory

- Time and money

- Shipping costs

- Chargeback fees

- Brand loyalty

- Increased transaction fees (including possible credit card penalties)

Besides the costs, merchants with sky-high chargeback rates can even see their merchant accounts shut down. Chargeback fees vary based on your chargeback history and payment processor, ranging from $15 to $100. Essentially, the more chargebacks you get, the higher the fees you'll likely have to pay.

Keep an eye on your chargeback ratio — the number of chargebacks divided by your total monthly transactions. For example, if you handle 500 transactions a month and get 25 chargebacks, your ratio is 0.5%. Aim to keep it under 1% to avoid steeper fees and possible fines.

Remember, even if you win a chargeback dispute, it still counts toward your chargeback ratio. Your best bet: Prevent chargebacks from happening in the first place.

Credit card chargebacks: Your rights as a merchant

Although chargebacks were developed as a consumer-protection mechanism, merchants have some recourse to fight chargebacks.

Here are a few rights merchants do have:

- Late delivery returns: If a customer makes a payment dispute because of late delivery, they must first attempt to return the product before initiating a chargeback.

- Representment: Merchants can submit proof of an illegitimate chargeback through this process.

- Arbitration: This is the final stage of a disputed chargeback, and it's rarely in the merchant's favor. Arbitration typically happens when a merchant's representment is successful. It's costly and often not worth the hassle.

How merchants can prevent chargebacks

Fortunately, there are several proactive steps you can take as a merchant to minimize chargebacks or even worse — chargeback fraud:

- Verify customer information: Always double-check the customer’s billing address and use an address verification system (AVS) to make sure the cardholder’s provided address matches the one on file with the bank.

- Track shipments: Use shipment tracking and require a signature on delivery to confirm the product actually reaches the right person.

- Clear billing descriptors: Ensure your business name is clear on billing statements so customers can easily recognize the charge and avoid filing disputes by mistake.

- Implement smart fraud tools: Leverage advanced fraud detection tools to catch suspicious credit card transactions before they turn into chargebacks.

- Offer exceptional customer service: Make it easy for customers to reach you with issues and resolve them quickly to prevent disputes from escalating.

- Keep detailed records: Maintain thorough records of transactions, communications, and delivery confirmations to provide solid evidence if a chargeback arises.

- Monitor chargeback ratios: Regularly check your chargeback ratio and take action if it starts climbing. This might mean tightening your fraud prevention or adjusting your return policies.

- Ban repeat offenders: Watch for customers who frequently file chargebacks and consider blocking them from future purchases to protect your bottom line.

Addressing chargeback FAQs

We’re answering a few common questions you might run into throughout the process:

How long does it take to resolve a chargeback?

The resolution process can vary, but cardholders usually get their refund within about 10 days. However, the entire chargeback dispute, including resolution, can take several weeks to months depending on the complexity of the case.

How can I lower my chargeback ratio?

Your chargeback ratio is the number of chargebacks divided by your total transactions. It’s important to regularly monitor this ratio and work to keep it below 1%. To help you maintain a low ratio, you can introduce improved fraud prevention measures, clear billing descriptors, and implement more comprehensive customer service.

What are the potential consequences of a high chargeback rate?

High chargeback rates can lead to increased fees, potential fines, and even account termination by payment processors; not to mention it can harm your business’s reputation and affect your ability to process payments effectively.

What types of transactions are most prone to chargebacks?

CNP transactions, like online and phone orders, are generally more susceptible to chargebacks due to the lack of physical card verification. But don’t be fooled — in-person transactions can also experience chargebacks, especially if there are issues with the transaction's authenticity or customer satisfaction.

Can chargeback fees be negotiated or waived?

In some cases, merchants can negotiate chargeback fees with their processors, especially if they have a history of low chargeback rates or are actively working to reduce them. However, this isn’t always possible, so it’s best to check with your payment processor to be sure.

How do chargebacks impact customer loyalty?

Chargebacks can put a real dent in your customer relationships, especially if they spark disputes or cause service interruptions. To keep things running smoothly, focus on top-notch customer service and clear communication. This will help mitigate any negative impact and preserve customer trust.

How often should I review my chargeback policies and practices?

Keep your chargeback policies and practices fresh by reviewing them regularly — typically quarterly or at least annually. Staying on top of industry standards and evolving fraud trends is key. Regular check-ins allow you to adapt your strategies, minimize risks, and tackle new challenges head-on.

Working with a leading payment service provider: Prevent chargebacks with expert advice

Managing chargebacks is both expensive and time-consuming. To steer clear, merchants should invest in a reliable payment processing system that helps maintain accurate records. Another smart move is resolving disputes directly with cardholders before they escalate.

It’s important to remember that chargebacks are an inevitable part of doing business, especially as eCommerce continues to grow. So, it's crucial to understand the process and how to minimize your risk. At Sekure, we’re small business allies, providing unbiased advice on payment processing and POS solutions. Our Payment Experts ensure you get the best deal and the ideal payment solution tailored to your unique needs — with security and fraud detection in mind.

Still have questions about chargebacks or anything payment-related? Reach out to one of Sekure’s Payment Experts — we’re ready to help.

Categories