Businesses often focus on getting customers through their doors and convincing them that their products and services are worthwhile, but a customer's experience doesn't end when they decide what they want to buy. In many ways, the success of a business hinges on the next stage: completing the purchase. When customers attempt to pay for their items, they expect a seamless, efficient process that doesn't cause unnecessary stress. If they receive anything less, they may be tempted to take their money elsewhere in the future. The effectiveness of an organization's payment processing technologies and merchant services thus has a significant effect on every other aspect of its operations.

Small and medium-sized businesses (SMBs) that want to compete with larger retails, establish customer loyalty, and provide the most pleasant checkout experiences for their customers can increase their chances of success by placing priority on finding the best payment technologies. For that to happen, they must first develop a thorough understanding of the fundamental tools used to accept customer payments, including payment gateways, point-of-sale (POS) systems, and card readers. With that knowledge in hand, business leaders can rest assured that they will make the right decisions when securing payment products and services.

Payment gateways and the basics of payment processing

Whether a business operates in person or online, a payment gateway is a common feature of their payment processing technology. As their name suggests, payment gateways create a path for customers to transmit their financial information to a merchant's bank, thus enabling customers to complete their transactions.

Payment gateways defined

The purpose of payment gateways is to collect, authorize, and transfer a customer's credit card information to a merchant's payment processor or bank. This front-end technology is present in brick-and-mortar stores as well as eCommerce sites, but its exact structure and appearance differs based on the specific business.

Payment gateways are essential for eCommerce stores. They include checkout pages or portals that customers use to complete their transactions. They use application programming interfaces (APIs) to facilitate communication between the website and the payment processing network.

While payment gateways are most closely associated with online shops, physical stores also use them to submit customer orders, collect payments for services, issue payment links, or allow customers to pay with QR codes. Rather than collecting customer information through a business website, in-store payment gateways use POS terminals with internet connections to transmit customer payment information.

Differentiating between payment gateways, payment processors, and virtual terminals

Payment gateways are sometimes confused with payment processors and virtual terminal credit card processing, and it's important to recognize the distinctions between them. They can be broadly defined as follows:

- Payment gateway: An online, customer-facing system that collects credit or debit card information, encrypts it, and sends it to a payment processor or bank.

- Payment processor: A service that connects the customer's bank and the merchant account, allowing the transaction to be completed.

- Virtual terminal: A system that employees use to enter card information on behalf of customers who aren’t present or don’t have their cards available.

Payment processors are used by essentially every business that accepts card payments, no matter whether it operates online or in person. In contrast, payment gateways are crucial to eCommerce, but SMBs with physical locations don't always use them.

Types of payment gateways

SMBs that decide to use a payment gateway must then determine which type of gateway is the best fit. They are typically broken into three categories, each with its own benefits and drawbacks.

On-site

Businesses can build on-site payment gateways directly into their websites, allowing customers to complete their transactions without traveling to an external page. This offers a high level of control over the checkout process, as businesses can determine what payment options they want to offer and how payment information is kept secure. It also simplifies the payment process by allowing customers to complete their transactions without moving to a new site.

However, SMBs that opt to use on-site payment gateways must exercise caution and take responsibility for the security of their customers' private information. Failure to do so could result in a data breach or other digital disaster that could result in long-term revenue and reputational losses.

On-site payment gateways are generally regarded as the most complex. As a result, they're often more popular with large businesses than SMBs. However, more tech-savvy owners of small businesses may prefer to keep their payment gateways in-house.

Redirects

Rather than including a payment page within their own site, many SMBs use redirects as their payment gateways. Customers add items to their carts and, when they're ready to complete their transactions, they're sent to a third-party website. The site allows them to enter their payment information or select a digital wallet and confirm their purchase.

Redirects reduce the hands-on management of payments because the external site takes responsibility for collecting and communicating payment details to processors or merchant banks. Most also have high-level security measures, which helps alleviate concerns about unauthorized data access or fraud.

On the other hand, redirects may deter some customers from finishing the checkout process. The overwhelming number of online scams makes some consumers hesitant to issue a payment through a site that is not directly tied to the merchant. Businesses can help mitigate these concerns by choosing a respected payment gateway provider with an established reputation for security.

Front-end

The final type of payment gateway is front-end. From the customer's perspective, it's often indistinguishable from an on-site gateway, but business owners will see substantial differences between them.

With a front-end gateway, the payment process is completed in two separate steps. First, the customer enters their payment details directly on the company's website, as is the case with an on-site payment. However, unlike an on-site gateway, the processing is handled by a separate, third-party system. The payment is encrypted for security, helping to ensure that customer information is protected. Businesses that want to be entirely hands-on with the payment process may want to avoid front-end gateways, but they offer a good mix of external support and internal control.

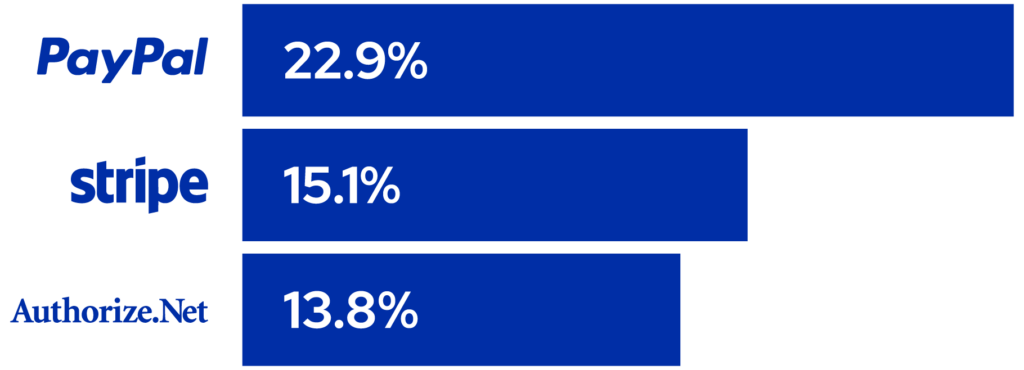

Payment gateway options for SMBs

When the time to choose a payment gateway provider arrives, SMBs have no shortage of options. Many large banks offer their payment gateway systems to business customers, and other providers are specifically in the business of assisting companies with their payment gateway needs. The most popular providers include:

- Authorize.net

- Square

- Stripe

- PayPal

Businesses can also choose to create their own unique payment gateways, but the cost is prohibitive for many SMBs. The software consultants at Softjourn estimate that it costs between $200,000 and $250,000 to create a payment gateway that meets the minimum requirements for security and customer use. As such, most SMBs can get much more value by using an existing gateway from a reputable provider, such as Authorize.net. Save on your payment gateway by taking advantage of Sekure's Authorize.net offer.

What to consider when selecting a gateway provider

A little research goes a long way when it comes to selecting the best payment gateway provider. Without comparing and investigating all of the available options, a business may end up paying excessive fees or struggling to meet customers' preferences and needs. Basic points to evaluate include:

- Cost: Providers typically charge monthly merchant processing fees and may also have fees for setup, batch transactions, and integration. Some also charge a percentage of each individual transaction cost.

- Payment types: Many payment gateways are capable of processing a variety of customer payments, but it's unwise to assume that a provider accepts all types of payments or cards. Business leaders can research which payment types are most popular with their customers to ensure that the payment gateways they select are a good match.

- International payments: If a business has customers in other countries, it's important to determine whether the gateway provider allows international payments. International customers may also have to pay additional fees for their transactions.

- Security: A payment gateway should be fully compliant with PCI DSS and other regulations. Known security vulnerabilities or recent data breaches may be a cause for concern, depending on the provider's response.

- Integration: SMBs can avoid potential headaches by verifying whether a payment gateway will easily integrate with their existing technologies and platforms. Full integration helps provide customers with a more straightforward experience and simplifies the payment process for business employees.

Some SMBs discover that a single payment gateway may not be capable of meeting all of their requirements. In those cases, a business might opt to use multiple gateways to fully realize all its goals and reduce the chances of extended downtime should one gateway fail.

What to expect from payment gateways in the future

Payment gateways are likely to remain a core component of business operations for many years to come, and they're likely to expand to accommodate new patterns and trends in the financial world, such as cryptocurrencies. Major shifts in consumer behavior, particularly the tendency to make purchases through eCommerce sites, have contributed to impressive growth in the payment gateway market. It was valued at more than $27 billion in 2022 and is expected to rise above $160 billion in 2032. The market for payment gateways is especially large in the United States, representing more than a 35% share of the market in 2021.

Accepting payments and tracking data with POS systems

Looking back at the history of payment processing, it's clear that POS systems forever changed the way businesses interact with customers, manage their inventory, and maximize their profits. For online, mobile, service-based, and brick-and-mortar SMBs, a quality POS system is indispensable.

The function of POS systems

POS systems allow businesses to accept customer payments, either with a physical terminal or a payment portal. They consist of a combination of software and hardware, such as:

- Barcode scanners

- Card readers

- Monitors

- Customer displays

- Cash drawers

- Receipt printers

- Keyboards

All of these elements may not be necessary for every business. For example, some businesses have moved to an entirely cashless payment system and no longer use traditional cash registers or cash drawers.

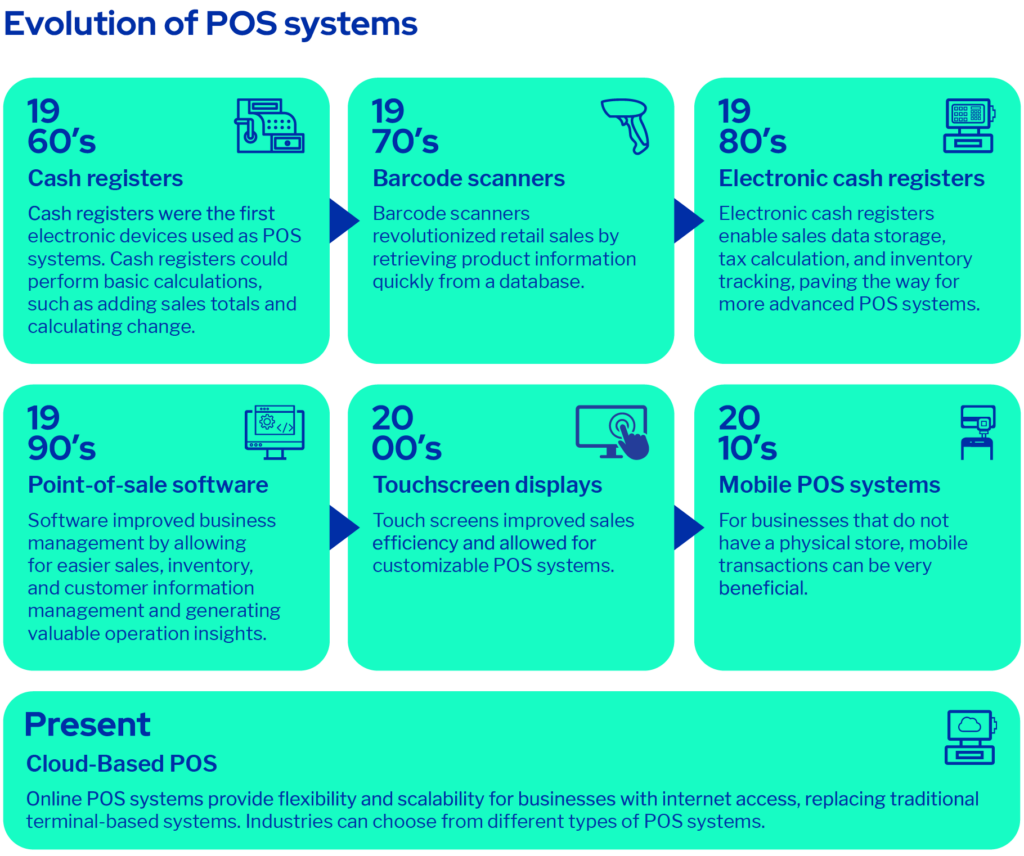

The evolution of POS systems

The POS systems that businesses use to accept payments online and in person are incredibly flexible, allowing customers to make payments with credit and debit cards, digital wallets, and payment apps. They bear little resemblance to the cash registers of centuries past, and their transformation, while slow, is a remarkable display of technological progress.

Humble beginnings

Although POS systems capable of accepting multiple types of payments may be commonplace in modern businesses, their origins were much simpler. The first cash register was invented in 1879 by the owner of a saloon in Dayton, Ohio. Prior to that point, merchants had no way of tracking the number of sales, and theft by employees was a regular occurrence.

While the cash register was a major step forward, it took almost another century before IBM released the first full-scale POS system capable of controlling multiple terminals at once. From that point, progress picked up the pace. The first PC-based POS system arrived in 1985, and Windows-compatible systems followed in the 1990s.

Modern marvels

Today's POS systems are often cloud-based, meaning that businesses store their payment data online rather than on a dedicated machine. This offers a number of benefits, including:

- Allowing employees to access the system at any time and from anywhere

- Storing data backups

- Receiving regular updates from the software provider

As a result of these improvements, cloud-based POS systems have become increasingly dominant in the market. They've also contributed to the growth of mobile POS terminals, which allow businesses to accept payments without access to a stationary terminal.

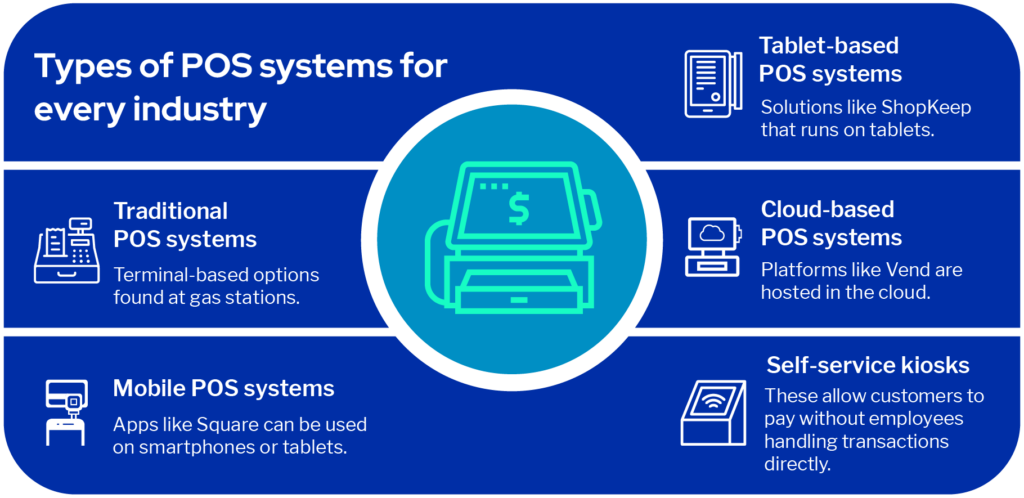

Types of POS systems

The POS systems available to businesses are extremely diverse, ranging from free downloadable apps to large terminals with multiple parts. Businesses can choose the systems that align with their structure, size, and goals. These are the primary kinds of systems used by today's SMBs:

- Legacy: Popular at brick-and-mortar stores, these POS systems include accessories such as barcode scanners and card readers.

- Mobile: When equipped with a POS app, smartphones and tablets can serve as payment terminals for businesses that want to remain mobile or accept payments from locations other than a central checkout line.

- Self-service kiosks: Many grocery stores and restaurants allow customers to checkout and pay for their orders without the help of a business employee.

- Multichannel: An SMB that has one or more physical locations as well as an online store can benefit from a system that combines customer and sales data from different platforms into a single location.

- Online: Businesses can use their tablets or phones to connect to online POS systems and complete customer transactions.

As with payment gateways, it's possible for businesses to collaborate with software engineers to design their own POS software. For most SMBs, however, the money and time required to complete such an endeavor outweigh any possible benefits.

How to use a POS system

No matter which type of POS system a business chooses, the process of using it is fairly predictable. The steps generally include:

- The customer or employee rings up an item or service.

- The POS system calculates the total price, including sales tax.

- The system updates the business's inventory to reflect how many items were sold.

- The customer submits a payment via a card, digital wallet, or cash.

- The system authorizes and finalizes the transaction.

- If requested, the system generates a receipt that the customer receives on paper, via text, or through email.

Depending on the design of the POS system and the business's preferences, customers may also be prompted to use reward points, provide a tip, or leave a review of their experience.

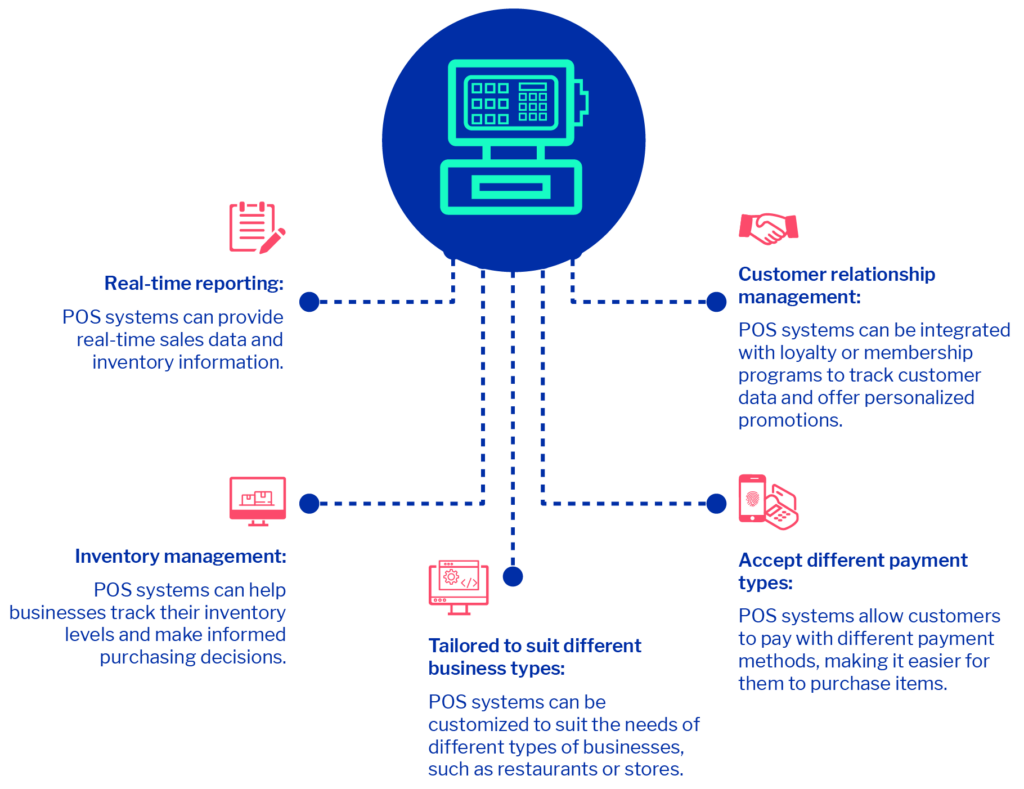

Industry applications of POS hardware and software

The benefits of POS systems are universal, no matter a business's industry or size. Organizations in retail, hospitality, healthcare, food service, wellness, and finance can use POS systems to enhance their operations and provide improved customer experiences. An effective POS system offers many advantages, such as:

- Inventory tracking: A POS system helps businesses update their inventory and monitor their sales. This information empowers them to make more informed decisions about stocking, marketing, and pricing.

- Customer engagement: Rather than using a punch-card to offer loyalty or membership rewards, an SMB can track a customer's purchases and visits digitally. This data is also useful for businesses hoping to offer personalized promotions.

- Customization: Modern POS systems enable businesses to tailor their payment experience based on their customers' needs and preferred payment types. This is ideal for SMBs that want to appeal to customers who use a variety of payment methods, including cash, cards, and digital wallets.

SMBs that attempt to operate without some version of a POS system place themselves at a distinct disadvantage not only in terms of satisfying their current customers, but also in finding ways to attract new customers, having a thorough understanding of their profits, and knowing which products are in demand at any given time.

Continued growth of POS systems

With such an integral part to play in payment processing, POS systems will remain a major concern for business leaders around the world, and the POS software market is experiencing a strong surge in interest. With a market size valued at $11.99 billion in 2022, POS software is expected to grow steadily through 2030. Experts project that mobile POS software will have an especially strong period of growth due to the increasing use of mobile POS systems. The transaction value in the mobile POS payments market is projected to reach $3.30 trillion in 2023.

The global POS terminal market size was valued at $94.40 billion in 2022 and will grow at a slightly slower rate than software. This is indicative of the transition to more adaptable and versatile POS systems, as well as the fact that many businesses plan to continue to use their existing POS terminals for several more years without upgrading or replacing them.

Card reader options for SMBs

From 2018 to 2021, the number of non-cash payments in the United States increased by a record-breaking 30.7 billion. Customers who had long been loyal to cash have moved to credit cards, debit cards, and contactless payments, making it more important than ever for SMBs to use functional card readers with updated technology.

Magnetic stripe readers

Like cash registers before them, magnetic stripe credit cards revolutionized the way customers paid for their purchases. These cards feature strips of tape with magnetic tracks that hold the credit card's data. The same technology is also used in access control cards, such as door keys for hotel rooms, reward cards, and ID cards.

Most existing credit and debit cards feature magnetic strips. Likewise, many POS terminals have card readers where customers can swipe or insert their cards into a slot. The reader detects the magnetic field around the strip, reads the data, and processes the payment. This was a massive improvement over past credit cards that businesses had to imprint onto a charge slip.

Magnetic stripe readers became popular in the 1970s because of their significant improvements over past cards. They were faster, easier to use, and more secure, reducing the risk of fraudulent charges. Despite these benefits, payments with magnetic stripe cards have definite disadvantages, including:

- Contact required: Customers must touch a POS terminal when they use their cards, increasing concerns about disease transmission and hygiene.

- Wear and damage: Magnetic stripes inevitably wear off or are damaged by frequent use, nearby magnets, water, and heat.

- Lacking security: Although magnetic stripe cards were a major advancement in security, they don't have the encryption of more recently developed payment methods.

Magnetic stripe card readers remained in fashion for decades after their introduction, but they’re gradually being replaced by competitors like chip cards and contactless payments. This became perfectly clear when MasterCard announced in 2021 that it would begin phasing out magnetic stripe cards in 2024 and eliminate all cards of this kind by 2033. With this in mind, forward-thinking SMBs would be well-served by investing in payment systems that can accept magnetic stripe cards, chip cards, and contactless payments.

Chip card readers

Chip cards have become a major contender in the battle of payment methods, but their rise to the top was a slow one, particularly in the United States. They were invented soon after magnetic stripe cards, but they failed to catch on until 1996, when Europay, MasterCard, and Visa joined together to develop the EMV card.

Chip cards, which contain embedded chips with encrypted data, are easy to use. Customers simply insert their cards into the reader and enter their personal identification number (PIN) to authorize the transaction. The card reader scans the card information and generates a one-time code before transmitting the data to the merchant's bank. This process yields a number of advantages for businesses and customers, such as:

- Enhanced security: In 2019, Visa released the results of a study that showed that EMV chip cards helped reduce counterfeit fraud by 87%, and overall card-present fraud declined by 40%. This improvement is primarily due to the fact that chip cards use dynamic codes that change between transactions, making it more difficult for criminal actors to obtain sensitive information and commit fraud.

- Durability: The critical component of a chip card, the chip itself, is contained inside of the plastic card. This protects it from the exposure and wear that have been so detrimental to magnetic stripe cards.

- Flexibility: The majority of chip cards and chip card readers also include the necessary technology for customers to make contactless payments. This allows customers to make multiple types of payments without carrying an additional card and without requiring the business to install an additional piece of hardware.

The benefits of chip cards are obvious, yet adoption rates in the United States have still lagged behind other countries. From July 2021 to June 2022, the percentage of card-present transactions that relied on EMV-chip cards was nearly 92% globally but only 84% in the United States. Similarly, around 63% of cards in the United States have EMV chips, compared to nearly 90% in Canada, Latin America, and the Caribbean.

SMBs located in the United States shouldn't take this lag as a sign that chip cards are unpopular with customers. Rather, they should consider it another reason to use payment technologies that offer as many payment options as possible and thus appeal to a wider audience.

Contactless payments

Like chip cards, contactless payment solutions have paved the way for a more convenient and secure customer experience. The adoption of contactless payments also parallels the slow rise of chip cards because customers in the United States have been reluctant to use them.

After their initial launch in 1996 by the Seoul Bus Transport Association in Korea, contactless payments quickly gained popularity in different parts of the world, but American consumers weren't entirely convinced of their value until the COVID-19 pandemic. During that time, customers appreciated that they could hold their cards, wearable devices, or smartphones above payment terminals and complete their transactions without having to touch any equipment or exchange money with a business employee.

The contactless payment trend that emerged during the pandemic has remained even as the rates of illness have waned. This is because, in addition to improving public health, contactless payments have many other upsides, such as:

- Protection from theft or fraud: Customers can lock their phones or smartwatches to prevent unauthorized access. Additionally, contactless readers use tokenization and encryption to secure customer data.

- Shorter checkout times: Because customers don't have to stop to swipe or insert their cards, they can generally check out more quickly. This helps reduce wait times and frustration on the part of employees and other business patrons.

- Low cost: Businesses usually pay the same processing rates for contactless payments as for chip and magnetic stripe credit cards. If they have to purchase a contactless card reader, the expense is usually minimal.

While these advantages have made contactless payments among the most popular payment methods in the world, the technology is still developing and limitations are still at play. Although the United States government doesn't have any laws in place that restrict how much money a customer can spend with contactless technology, some card issuers and businesses have put their own limits in place. This could prove detrimental and inconvenient if a customer is unable to complete a purchase because they have spent the maximum amount of money allowed by their contactless payment provider.

Nevertheless, contactless payments are finally taking hold in businesses throughout the United States. In 2020, the National Retail Federation's annual report explained that 67% of retailers accepted some form of no-touch payment, a number that continues to grow. The financial prospects for the global contactless payment market are equally remarkable. Valued at $29.89 billion in 2022, the market is projected to exceed $132.42 billion by 2032.

Fortunately, SMBs usually don't have to invest much time or effort in making a positive impression on customers who increasingly expect contactless payment options. Businesses with stationary terminals are often already equipped for contactless payments, and companies on the go can use their smartphones, tablets, or portable mobile card readers to take payments from customers with contactless cards or devices.

Improving businesses with better payment technologies

Implementing the right payment technologies can make an enormous difference in the success of a small business. Allowing customers to use their favorite payment methods, providing a higher level of data protection, and speeding up the checkout process are only a few of the reasons that modern payment technologies are an asset to businesses. However, the process of differentiating between payment technologies, integrating them into established payment systems, and deploying them to customers can be overwhelming for even the most experienced business leaders.

Sekure's Payment Experts are dedicated to helping SMBs find and use the best eCommerce solutions and the payment technologies that are most beneficial to them. Businesses ranging from grocery stores to salons to online shops can learn which technologies are most suitable for their structure, size, and purpose. The certified specialists at Sekure provide one-on-one consultations with tailored guidance and a free savings analysis for businesses that want to optimize their payment processes and have lower processing fees.

Categories