Mobile payments are transforming transactions in the digital age

Over the past two decades, the payment processing landscape has undergone a major evolution. Consumers have turned away from carrying wallets full of cash and instead rely on credit and debit cards and smartphones to complete both their everyday and big-ticket purchases. Mobile payments, payments that are made using mobile devices such as cell phones, tablets, and wearable devices, are at the center of this major transition.

Although it has taken time for mobile payments to establish mainstream appeal in the United States, experts project that their growth will be explosive over the next several years. The mobile payment market size was valued at approximately $53.5 billion in 2022, and it's estimated to exceed $607 billion by 2030. This reflects not only a heightened level of interest in payment versatility but also in more portable, versatile business structures.

For small and medium-sized businesses (SMBs), mobile payments are a means of meeting consumer preferences, attracting new customers, simplifying payment processes, and saving money. Three of the most prominent tools for collecting mobile payments are near-field communication (NFC), Quick Response (QR) codes, and mobile card readers. SMBs that don't currently accept mobile payments or that want to expand their systems to accept different payment types can benefit by adopting one or more of these systems. Before deciding which type of mobile payment technology is the best fit, it's important to first have a full understanding of their different approaches to collecting payments.

The push for mobile payments

Mobile payments have a longer history than many people realize. They began rather quietly in 1997 when Coca-Cola deployed vending machines with mobile payment capabilities in Helsinki. Customers who wanted to purchase a drink could make the purchase via text message, and the cost would be added to their next cell phone bill. Additional machines were later installed throughout Finland, Norway, Sweden, and Great Britain, but the concept remained fairly limited in scope.

However, what Coca-Cola began with a few hundred SMS-enabled vending machines later grew into a redefining movement that permanently altered the way that consumers make purchases. Modern SMBs face increasing pressure to offer mobile payment options to satisfy customer demand and develop an edge over competitors.

The shift to cashless transactions

The public's relatively newfound appreciation for mobile payments is tied to an overall progression away from using cash to pay for products and services. The change has occurred gradually but steadily all over the world. In 2012, consumers in the United States used paper currency for 40% of their payments. By 2019, the number dropped to only 26%.

More recent studies show that the trend away from cash continues. In 2022, a Pew Research Center survey found that more than 40% of Americans don't use cash for any transactions during a typical week, and those that do are typically age 50 or older. Moving forward, it's likely that younger generations will continue the push toward a society that’s at least partially cashless, elevating the need for mobile payments to an even higher degree.

Increased smartphone adoption

The growth of mobile payments is also strongly tied to the increasingly ubiquitous nature of smartphones. As of 2023, there are approximately 311.8 million smartphone users in the United States, and that number is expected to grow beyond 364 million by 2040. According to the Pew Research Center, this translates to around 85% of Americans owning a smartphone.

For SMBs, the widespread and constant use of smartphones is critical. Smartphone users no longer rely on their phones exclusively as a method of communication. Their mobile devices also serve as their primary connection point for social interactions, work, and financial management. With so many devices in the hands of consumers, it's no surprise that mobile payments have become such a prominent aspect of business transactions.

The effect of COVID-19

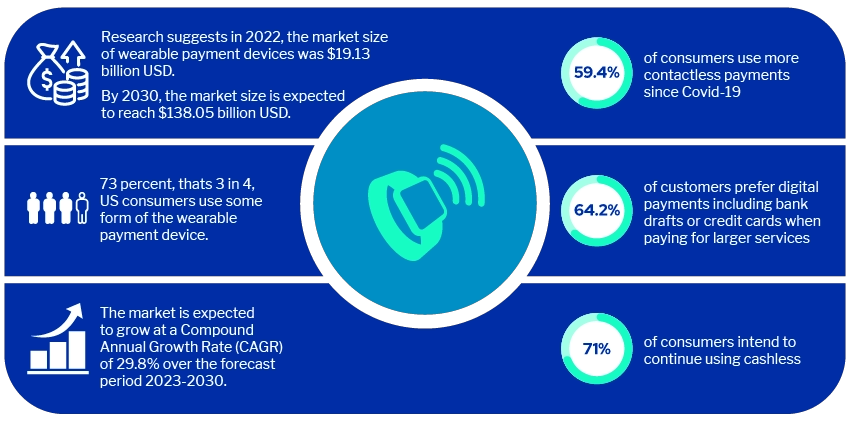

American consumers and businesses tend to adopt new payment technologies at a slower rate than other countries, and mobile payments are one such case. Prior to the COVID-19 pandemic, these kinds of payments were already well-established in areas such as South Korea and Singapore, but the trend had yet to gain full steam in the United States. However, the arrival of COVID-19 drastically altered consumer perspectives on payment technologies and encouraged the use of contactless payment solutions.

An April 2020 study by Mastercard revealed that, as cities, states, and businesses instituted their initial restrictions in response to the spread of COVID-19 in February and March of that year, contactless transactions in drug and grocery stores grew twice as quickly as non-contactless transactions. This was a natural response to concerns about disease transmission and public health, as contactless payments, including mobile payments, are largely regarded as cleaner and safer than more traditional payment methods such as cash and checks.

The accelerated shift toward mobile payments that was spurred by COVID-19 remained even after social distancing mandates were lifted. Customers who became accustomed to using their phones to make payments continued to do so, and SMBs have adjusted their systems accordingly by adopting new and upgraded systems with the ability to accept a wider range of payment types.

The power of near-field communication

SMBs that want to accept mobile payments have a number of options, but NFC is the underlying technology that makes many such payments possible. It's also among the most popular and rapidly growing payment technologies available on the market today, and it's one that every SMB should consider when determining how and where to accept mobile payments.

The history of NFC technology

NFC makes use of radio waves to transmit information from one object to another, such as a smartphone to a point-of-sale (POS) terminal. The technology was developed on the foundation of radio frequency identification (RFID), which was originally developed primarily as a means of simplifying logistics and transportation. In 2004, the NFC Forum, an organization that began as a collaboration between Nokia, Philips, and Sony, brought NFC into the limelight and began fully exploring its potential for use in payment technology.

The implementation of NFC readers was slow following the initial formation of the NFC Forum. In 2007, Nokia released the first NFC-enabled phone, but it wasn't until ten years later that a major organization in the United States fully took the leap into NFC payments. It finally occurred in 2017, when New York City's Metropolitan Transit Authority unveiled a system that allowed riders to pay for their fares with NFC technology.

Preparing to accept NFC payments

NFC enables SMBs to accept payment from smartphones, wearable devices, and compatible debit and credit cards. To do so, business owners must first install NFC-enabled readers onto their desktop POS terminals. In addition, they must ensure that their credit card processing provider accepts digital e-wallet payments. Although most modern merchant account providers include NFC payments in their services, some do not.

Accepting NFC payments is generally affordable for businesses because processing fees for NFC payments are usually similar to or the same as traditional card payments. While SMBs may have to purchase separate NFC readers to add to their existing terminals, they cost between $50 and $150, on average. Many of today's POS terminals are also sold with pre-installed NFC capabilities, so new or recently established businesses may be able to avoid investing in separate technology altogether.

The ability to accept NFC payments isn't limited to stationary terminals. Most mobile devices are also equipped with NFC technology, so SMBs without full POS systems can use their devices to accept payments from NFC-enabled cards and mobile payment services such as Apple Pay or Google Pay.

The NFC payment process

Once the necessary hardware has been installed, accepting NFC payments is a straightforward and generally seamless process. When customers are ready to pay for their purchases, they merely have to hold their smartphones or NFC-enabled cards in front of the reader for a few moments. The payment information from the card or app on the customer's phone is encrypted and transmitted via radio waves to the reader and the payment is processed.

Unlike RFID, which is typically effective at distances of dozens or even hundreds of feet, NFC has a very short range of detection. In most cases, customers must hold their NFC-enabled cards, smartphones, or other devices no more than four centimeters from the reader. While the short-range capability might initially seem like a limitation, it helps protect customers from inadvertently paying for a nearby person's purchase and lowers the likelihood of theft or fraud.

Benefits of NFC-enabled systems

Although much of the movement toward NFC payment systems has been driven by consumer preferences, they're widely regarded as a smart investment for businesses. They not only represent an SMB’s investment in up-to-date technology but also offer other distinct advantages, such as:

- Convenience: Customers often have their smartphones on hand, making it easy for them to hold up their devices in front of an NFC reader and make a payment. At the same time, NFC technology doesn't exclude customers who prefer to pay with cards, allowing them to place their debit and credit cards in front of the terminal to pay.

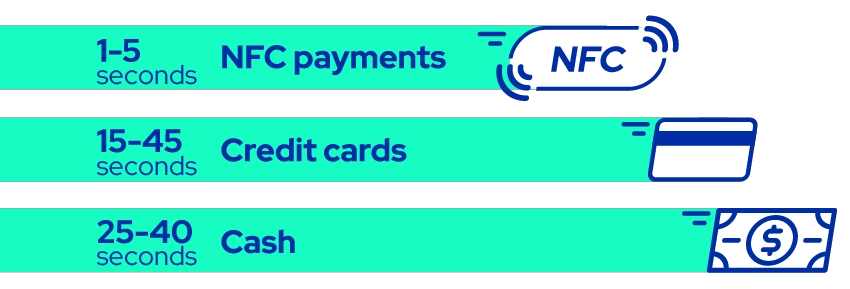

- Speed: NFC payments are extremely fast, especially in comparison to chip or swipe cards. The payment process is typically complete in a matter of seconds, which reduces customer frustration and keeps checkout lines moving.

![Speed benefits of NFC payments infographic.]()

- Security: In addition to proximity protection, NFC readers encrypt customer data to protect it from hackers. This makes them equally as safe as chip cards and much safer than magnetic stripe cards.

- Customer satisfaction: Businesses can attract the interest of new customers by offering NFC payments. A study by Visa found that 63% of consumers would frequent a new business if it offered contactless payments.

Because readers are available at a low cost and most customers already have NFC-compatible devices or cards, making the changes to accept NFC payments is very low risk and offers a high potential for financial and reputational reward.

NFC applications for SMBs

NFC technology is available and advantageous for practically every type of business. SMBs that may benefit from accepting NFC payments include:

- Retail stores: Clothing, department, and grocery stores with stationary terminals are well-suited to NFC payments.

- Restaurants: Diners can make NFC payments at a central register or with tableside NFC readers

- Medical providers: Dentists, doctors, and other healthcare providers can shorten patient check-in and checkout times with NFC readers.

- Mobile businesses: SMBs that travel from place to place, including pop-up shops and food trucks, can use tap-on-phone technology to accept NFC payments with their mobile devices.

Some other forms of mobile payments require a higher level of technical knowledge by customers, which, in turn, can be a challenge to consumers who are more accustomed to using credit cards. NFC readers, however, allow customers who prefer to use credit and debit cards to continue using their preferred payment method in a slightly different way.

The future of NFC payments

Experts predict that NFC will remain one of the most dominant mobile payment technologies for the foreseeable future. The ability to accept NFC payments with mobile phones makes the technology more inclusive than ever before. According to a forecast from Insider Intelligence, 43% of smartphone users will use proximity mobile payments in 2023, and that number will continue to grow over the next several years.

The future growth of NFC payments is closely related to the consumer age. Experts project that there will be 22.5 million new proximity mobile payment users through 2027, and 88% of them will be younger generations, particularly Gen Z and millennials. Although older users have been more hesitant to switch from paying with cash or swiping or dipping their cards, the enthusiastic adoption of NFC by younger adults will likely catapult technology into a long and successful future.

Accepting payments on the go with mobile card readers

Mobile card readers marry consumers' preference for card payments with business owners' desire to free their operations from their reliance on large desktop POS terminals. From roadside stands to grocery stores, mobile card readers offer a variety of applications and opportunities for SMBs.

How mobile card readers began

In the late 1990s and early 2000s, customers showed increasing interest in using credit and debit cards for their purchases, a trend that continues to this day. In a 2022 report, Fiserv revealed that around 75% of consumers prefer to make in-store payments with debit and credit cards rather than cash.

Jack Dorsey and Jim McKelvey launched their start-up, Square, in 2009 in response to what they saw as an emerging need in the market. Their goal was to convert existing mobile technology, such as phones or tablets, into portable POS terminals that businesses could take with them to different locations. The result was mobile card readers, small devices that businesses could connect to their personal or business mobile devices in order to accept card payments.

How to use mobile card readers

Accepting payments with mobile card readers requires a minimal investment of time and money. Businesses merely need to purchase a miniature card reader that attaches to a smartphone or tablet, thus creating mobile POS systems. The reader functions in much the same way as a standard POS machine, allowing customers to swipe, dip, or tap their debit or credit cards to complete a transaction.

Earlier versions of mobile card readers connected to mobile devices with cables inserted in the headphone jack. However, most modern versions connect via Bluetooth, eliminating the need for cumbersome wires.

In addition to the physical device, businesses must also install a compatible app that captures, encrypts, and transmits payment details from the customer's bank account. They may also be able to integrate their mobile card readers directly with their existing POS software or application, simplifying the installation and set-up process.

Why SMBs use mobile card readers

The popularity of mobile card readers rests primarily in their portability. They allow SMBs to accept payments from anywhere, including different locations within a physical location. For example, a store employee can accept card payments from customers anywhere in the store rather than funneling all of them through a single checkout line.

Businesses also use mobile card readers for several other reasons, including:

- Minimal hardware costs: Most mobile card readers are available for under $100, making phone and tablet POS systems far more affordable than desktop POS machines. The associated software is typically free to download and use.

- Equivalent processing fees: Merchant service providers usually charge processing fees that are the same as those charged for online purchases. Rates generally fall between 2.5% and 3.5%, and most don't charge monthly fees.

- Familiar technology: Unlike some other mobile payments, mobile card readers have little to no learning curve for the business or consumer. They rely on the same system that traditional card readers have used for many years, allowing less tech-savvy consumers to feel more comfortable with making a mobile payment.

- Strong security: The security of a mobile card reader is usually equal to that of a stationary POS terminal. Customers who dip or tap their cards are typically very well-protected, while those who swipe their cards are more vulnerable to fraud or theft.

Although many business owners see mobile card readers as a transition to a fully digital POS system, the technology is versatile in terms of record keeping preferences. SMBs can offer printed receipts to customers by connecting their mobile devices to a wireless printer and offering paper receipts to customers who prefer them to email or text receipts.

Types of SMBs that use mobile card readers

Mobile card readers are used widely by businesses across multiple industries. Some brick-and-mortar SMBs use portable devices for pick-up windows or curbside sales where customers don't enter the store and access the primary POS terminal. Likewise, servers in restaurants often take mobile card readers to patrons' tables to accept payments rather than taking the check back to a stationary machine.

Mobile devices equipped with card readers are also an asset to businesses that serve customers at varied locations, such as:

- Farmers markets and festivals

- Delivery services

- Trade events

- Food stands and trucks

Although mobile card readers have broad applications, they aren't necessary for every organization. For example, most medical facilities accept customer payments through a central terminal that also holds private medical records. When deciding whether a mobile card reader is a logical addition to a POS system, SMBs should consider whether they could gain speed or efficiency by making their checkout process fully or partially portable.

The future of mobile card readers

Mobile card readers play an enormous role in allowing SMBs to make their operations more flexible, and the market reflects their steadily rising popularity. The 2022 market value for mobile card readers was just over $10 billion, and experts project that the value will grow to around $65 billion over the next ten years. This growth will likely be enhanced by improved analytic capabilities and new software features.

Despite their prominence in the world of mobile payments, mobile card readers face new competition from tap-to-pay technology, which also offers customers the option to make card payments on a vendor's mobile device. However, mobile card readers have the distinct benefit of allowing customers to swipe and dip their cards, which is important for customers who don't have NFC-enabled cards or smartphones or who prefer not to use proximity technology.

Embracing convenience with QR codes

Quick Response (QR) codes can be found everywhere, from flyers hanging on store windows to electronic billboards. They offer a fast and easy way for customers to connect directly with a business's website or payment profile on peer-to-peer payment apps such as PayPal, Venmo, and Cash App, making them an especially versatile and effective payment solution.

The origins of QR code technology

QR codes were developed in 1994 by a Japanese company known as Denso Wave. They were initially designed to allow companies to track parts during automobile assembly, and their applications in manufacturing, inventory, and logistics were long-lasting. However, because the general public didn't have the capability to easily scan or use QR codes, they were initially deemed a failure for public use.

That perception rapidly changed when smartphones gained the capability to scan QR codes. They were no longer useful only for behind-the-scenes purposes but also for marketing, sales, engagement, and payment processing solutions. As a result, the adoption of the technology rapidly grew, and around 89 million people in the United States scanned a QR code on their smartphones in 2022, a 26% increase over 2020. Businesses have recognized the growing appeal of QR codes, and a 2022 report from Square indicated that 25% of businesses now offer QR code payments.

The technology behind QR codes

A QR code is a type of barcode that stores information as a series of pixels. Comprised of a series of dots and lines, the code connects customers to a specific page or website.

Anyone with a smartphone equipped with a camera application or QR scanner can make a payment using a QR code. When the customer scans the code, they’re directed to visit a payment page where they can enter their information or complete a transaction with a digital wallet.

The process is also effective in the reverse. A customer who uses a payment app or digital wallet can generate a QR code on their phone. Vendors can then scan this code to retrieve the customer's payment information and complete the transaction.

Static and dynamic QR codes

SMBs that consider using QR codes for payment processing will have to choose which type of code to generate. They can select between two variations: static and dynamic. To decide between them, business owners must consider a number of factors, including:

- Adaptability: Static codes can't be changed after they've been generated, which is problematic if the scan destination needs to be updated. Dynamic codes, on the other hand, can be edited as needed without generating a new code.

- Speed: Dynamic codes use shorter URLs, which typically results in faster response times. Customers attempting to make payments with static QR codes may have to wait longer for the page to load.

- Analytics: SMBs can learn a lot about their customers with QR codes, but static codes don't provide analytic capabilities. With dynamic codes, businesses can access a trove of information related to the number of unique visitors, time of payment, and type of device used to complete the scan.

Regardless of which type of code businesses elect to use, the process of creating a code is simple. Online generators produce both dynamic and static codes, and many have built-in dashboards that allow SMBs to monitor their analytics and print reports.

The advantages of QR codes

In addition to gaining valuable data from analytics, SMBs can also benefit from QR code payments in other ways. These include:

- Convenience: Rather than waiting for help from a salesperson or server, customers can make QR code payments whenever they want. This gives them more control over their shopping or dining experience.

- Affordability: QR codes don't require special readers or devices, making them one of the least expensive payment options. Businesses can print QR codes on menus, signs, or sheets of paper and post them in convenient locations.

- Flexibility: Businesses with rewards or loyalty programs can connect them to QR payments. When customers scan a QR code to make a payment, their points are automatically tracked, eliminating the need to scan receipts or provide phone numbers.

- Security: QR codes are tokenized and encrypted, which means that businesses don't store sensitive customer data that could be stolen. This makes them one of the most secure payment options available.

QR codes are unique from other payment processing technologies in that they require customers to have a functioning smartphone. This could potentially alienate customers who prefer to pay with cash or cards. SMBs who have this concern may benefit by combining QR codes with an additional payment system, such as an NFC or mobile card reader.

Businesses that benefit from QR code payments

QR code payments are perhaps most popular in restaurants, where they help to eliminate customer wait times and allow SMBs to offer combined services. For example, a restaurant can print a QR code on a place mat or wall sign. The customer scans the code to access the menu, select their food, and pay for their order. Restaurants can also offer QR codes as an alternative to cards or cash by printing them on paper bills, which customers scan to make their payments.

The use of QR codes can potentially replace a full-scale POS system for many mobile businesses, including:

- Food trucks

- Freelance artists and entertainers

- Service providers, including pet groomers, cleaners, caterers, and locksmiths

- Traveling boutiques

Businesses that aren't tied to a particular location can print QR codes on business cards, flyers, or pre-printed invoices. Alternatively, they can allow customers to scan the code on a phone or tablet.

What's next for QR code payments

Consumers who are open to other forms of mobile payments, such as mobile card readers, have been somewhat more reluctant to use QR codes. By nature, QR codes involve a greater reliance on technology on the part of the customer, and older generations are sometimes wary of making this kind of change.

However, a recent study of American restaurant-goers found that approximately 70% of people under the age of 60 said that they were comfortable using QR codes to view menus, place orders, and make payments. This accepting attitude toward QR code payments is also reflected by its market value, which is likely to grow to more than $11.67 billion in 2023 and will surpass $55.60 billion in the next decade as adoption rapidly increases.

Choosing the right mobile payment solutions

When SMBs decide to accept mobile payments, they’re forced to decide what types of hardware and software will best complement their products, services, and systems. NFC, mobile card readers, and QR codes each have significant advantages. This makes it challenging for many SMBs to narrow down their options and determine which type of technology would be the most advantageous.

Sekure Payment Experts are well-versed in the complexities of mobile payment systems and can help SMBs from every industry, including grocery stores, restaurants, and healthcare, select the right equipment, satisfy customer demands, and get the best credit card payment services and rates.

Sekure offers a free savings analysis to help SMBs cut their processing costs and provides one-on-one consultations with specialists who are certified in the field. Whether a business wants to accept one type of mobile payment or integrate multiple mobile payment technologies into a single system, Sekure Payment Experts are ready to help.

Categories