What does it mean to accept ACH payments?

To accept ACH payments means enabling your business to receive funds directly from a customer’s bank account using the Automated Clearing House (ACH) network. Instead of relying on paper checks or credit card processing, ACH transfers move money electronically between bank accounts.

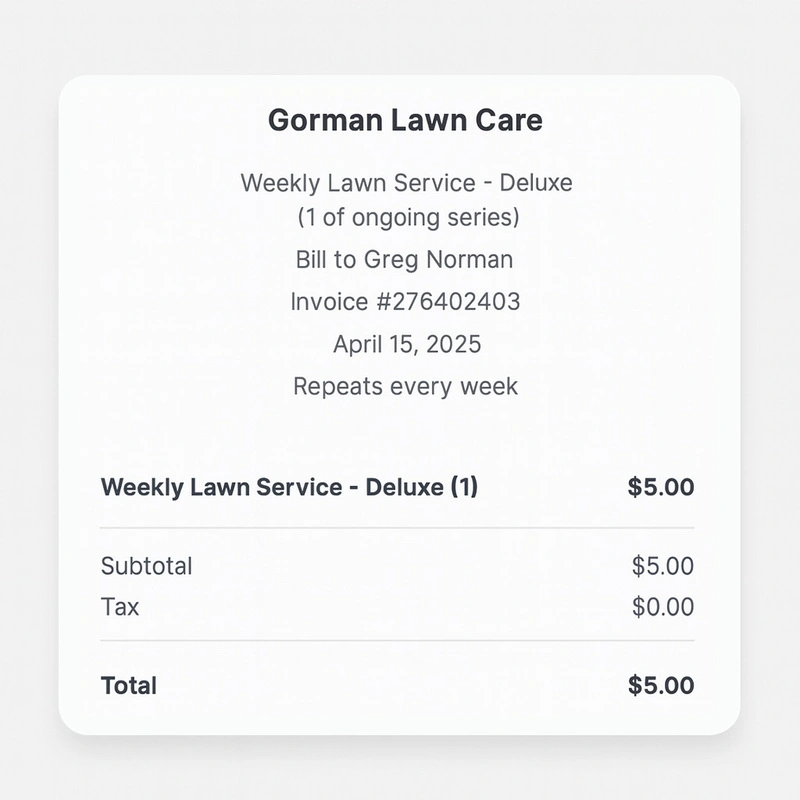

When you accept ACH, customers authorize a transfer—either one-time or recurring—and the funds are securely deposited into your business account. It’s the perfect option for recurring payments, service subscriptions, B2B billing, and professional services where reliability and cost savings matter.

Accept ACH payments in 3 simple steps

Getting started with ACH payments is simple. Follow these quick steps to start collecting secure, low-cost bank transfers from your customers.

1. Enable ACH payments

To begin accepting ACH payments, you’ll first need to activate the option in your account. Once it’s set up, ACH will appear as a payment method for your customers at checkout or when paying an invoice. This ensures that your business is ready to accept ACH payments instantly and securely.

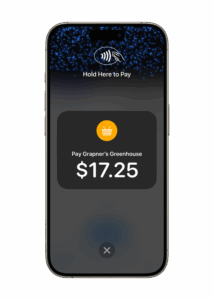

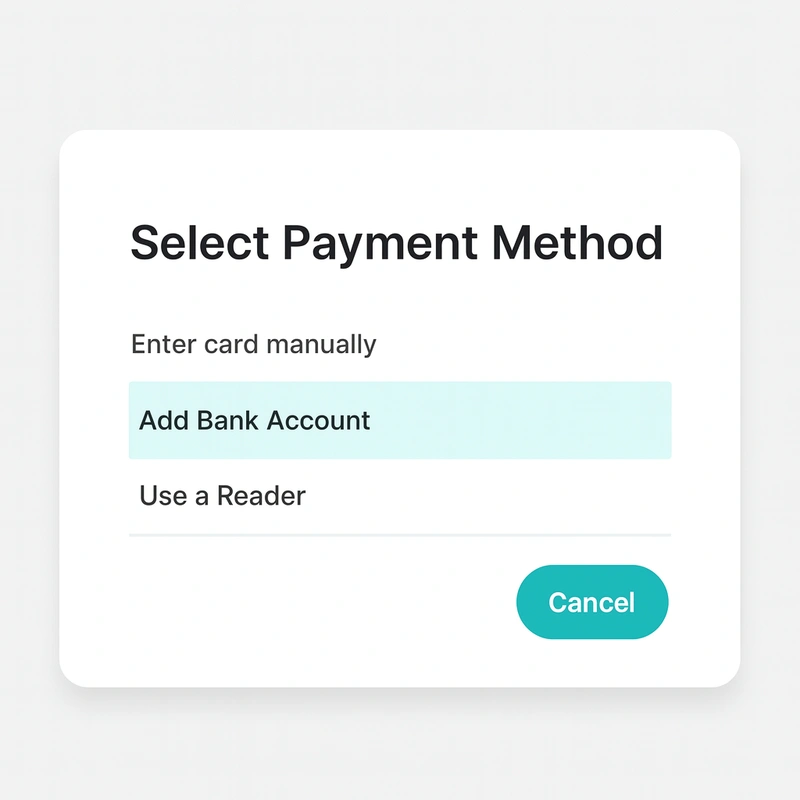

2. Collect the payment

When a customer selects ACH as their preferred payment method, they’ll be guided to a secure online portal where they can log into their bank and choose the account they’d like to use. If you accept payments over the phone, customers can also provide their bank details directly to you.

3. Receive the funds

After the payment is submitted, both you and your customer will receive confirmation right away. The transaction is then processed electronically, and the funds are deposited into your bank account.

The smarter, affordable way to get paid

Business owners are always looking for ways to save on fees, speed up cash flow, and simplify the payment process—and ACH payments check all those boxes. When you accept ACH payments, you’re giving your customers a convenient, secure, and cost-effective alternative to credit cards or checks, while keeping more money in your pocket.

Lower transaction fees

ACH payments typically cost less than credit card transactions, making them ideal for high-value or recurring payments.

- Transaction fees that are often up to 80% lower than credit card processing.

- Greater profit margins for high-ticket or recurring payments.

- Fewer surprise costs compared to traditional card networks.

Streamlined cash flow

When you accept ACH payments, money moves directly between accounts—no waiting on paper checks or manual deposits.

- No trips to the bank or waiting for mailed payments.

- Predictable cash flow, especially for ongoing services.

- Better financial forecasting with automated transactions.

Secure and reliable transfers

ACH payments are compliant with the Nacha regulations and best practices to safely and securely process ACH transactions.

- Reduced risk of fraud and chargebacks.

- Automatic verification of bank account details.

- Bank-level encryption and strict compliance standards.

Ideal for recurring or large transactions

If your business bills clients monthly, collects retainers, or manages memberships, ACH payments are built for you.

- Automatic recurring billing for subscriptions or service plans.

- Lower costs on large or ongoing payments.

- Convenient for both you and your customers.

Built for businesses like yours

No matter what industry you’re in, learning how to accept ACH payments can completely transform the way you get paid. Whether you manage recurring billing, handle large invoices, or process donations, ACH offers flexibility, reliability, and cost savings your business—and customers—will love.

Professional services

Simplify invoicing for consulting, accounting, or legal services by setting up recurring ACH payments with clients.

- Automate retainers or monthly service fees.

- Reduce time spent chasing invoices.

- Offer clients a secure, professional payment experience.

B2B transactions

When large payments are the norm, ACH keeps things simple and affordable.

- Transfer funds directly between business accounts—no cards or paper checks.

- Lower transaction fees on high-value payments.

- Build stronger relationships with partners through smoother payment experiences.

Healthcare providers

Move beyond paper billing with ACH payments that make patient payments easy and reliable.

- Collect co-pays and recurring charges automatically.

- Cut down on payment delays and administrative work.

- Provide patients with a secure, compliant payment option.

Non-profits

Make donating simple, seamless, and secure for your supporters.

- Accept one-time or recurring donations via ACH.

- Keep more of every donation with lower processing fees.

- Offer donors an easy, trusted way to contribute directly from their bank accounts.

Unlock the power of ACH payments

Implementing ACH payments as part of your payment strategy doesn’t just make transactions smoother—it transforms the way your business handles money. When you accept ACH payments, you open the door to faster transfers, lower fees, and greater reliability compared to traditional payment methods. Whether you’re a small business looking to streamline operations or a growing company managing recurring billing, ACH gives you the control and consistency you need to scale confidently.

Give your customers more ways to pay

Don’t limit your sales to one channel. Alongside ACH, expand your payment options to meet customers wherever they are—whether they’re in-store, online, or on the go. Offering multiple payment methods helps you close more sales, improve customer satisfaction, and keep your business running smoothly.

Pay for what you need and never what you don’t

POS hardware rentals can be expensive. That’s why our Payment Experts help you save on both POS software and equipment.

In most cases, our Payment Experts make sure your payment processor provides hardware free of charge, so you only pay for what your business actually needs.

Plus, with our Rate Sekurity Guarantee®, you can be confident you’re always getting the best possible deal—no surprises, no hidden costs.