Turn one-time sales into steady income –with recurring billing

Think of recurring billing as your automatic payment assistant. Once a customer signs up, they’re charged on a regular schedule—monthly, quarterly, or annually—without you having to lift a finger.

Each transaction is processed securely and seamlessly, reducing the risk of missed payments, delays, or awkward reminders. Your customers appreciate the convenience too — no need to log in and pay each time; it’s all taken care of automatically.

Perfect for businesses like yours

Recurring billing is a perfect fit for any business that relies on predictable, ongoing relationships or repeat payments.

Payments on autopilot with recurring billing

Recurring billing isn’t just a payment method—it’s a smarter way to run your business. By automating your payments, you unlock time, consistency, and stronger relationships with your customers.

Predictable, reliable revenue

Say goodbye to the ups and downs of unpredictable cash flow. With recurring billing, you can:

- Count on a steady stream of income each month.

- Plan budgets and investments with more confidence.

- Anticipate demand and manage inventory more efficiently.

Boosted customer retention

Customers stick around longer when paying is effortless. Recurring billing helps you:

- Eliminate friction from the checkout process.

- Build stronger, longer-term relationships with loyal customers.

- Reduce churn by making renewals automatic and hassle-free.

More productivity, less paperwork

Manual billing is tedious—and errors can be costly. With automated recurring payments, you can:

- Cut down on repetitive admin tasks.

- Reduce errors and missed invoices.

- Free up your team to focus on customer service and growth.

Seamless customer experience

Professional, predictable, and effortless—just how customers like it. Recurring billing delivers:

- Flexible payment options (credit card, ACH, etc.).

- Transparent and consistent billing schedules.

- Peace of mind knowing payments are processed securely every time.

Setting up recurring billing is easy, with Sekure

Getting started with recurring billing doesn’t have to be complicated. In fact, once you set it up, it practically runs itself. Whether you’re a solo entrepreneur or managing multiple accounts, these steps will get your recurring payments up and running smoothly.

Create a New Invoice

Start by creating an invoice in your payment portal or invoicing system. Enter your customer’s contact details and basic information about the product or service.

Choose “Recurring” as the Invoice Type

Select the recurring or automatic billing option. This tells the system to send invoices on a regular schedule without needing to recreate them each time.

Set the Frequency and Duration

Decide how often you want the invoice to repeat—weekly, monthly, quarterly, or annually—and when you’d like it to end (after a set number of payments or indefinitely).

Add Payment and Delivery Details

Attach the payment method on file or allow your customer to enter one through a secure payment link. Choose how invoices are delivered—by email, SMS, or through a customer payment portal.

Send and Automate

Once your settings look good, send the first invoice and let automation handle the rest. You can always monitor payment activity, update details, or pause the billing series as needed.

Security and compliance you can trust

Protecting your customers’ payment data is critical—and recurring billing solutions are designed with security and compliance in mind.

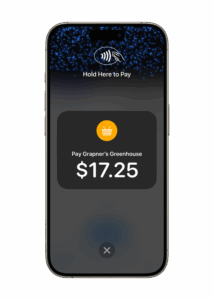

Give your customers more ways to pay

Make every transaction seamless by offering flexible payment options at the point of sale. With modern payment solutions, customers can pay the way they want.

Pay for what you need and never what you don’t

POS hardware rentals can be expensive. That’s why our Payment Experts help you save on both POS software and equipment.

In most cases, our Payment Experts make sure your payment processor provides hardware free of charge, so you only pay for what your business actually needs.

Plus, with our Rate Sekurity Guarantee®, you can be confident you’re always getting the best possible deal—no surprises, no hidden costs.