The touch-free way to pay

Tap to Pay is a contactless payment technology that allows customers to complete transactions by holding a compatible card or mobile device near a payment terminal equipped with NFC (Near Field Communication) technology. This “NFC tap and pay” process securely transfers payment data between devices without physical contact.

Make every payment a simple tap

NFC payment technology has quickly become the global standard for fast and secure payments—ideal for today’s on-the-go businesses and customers. Tap to Pay lets customers pay however they prefer—whether it’s with a card, smartphone, or smartwatch.

Card

Customers can simply hold their credit or debit card near your reader to complete the transaction.

Mobile wallets

Tap to Pay works seamlessly with digital wallets like Apple Pay, Google Pay, and Samsung Pay.

Wearables

For ultimate convenience, Tap to Pay also supports payments made directly from smartwatches.

Set up Tap to Pay in seconds

Setting up Tap to Pay for your business is fast, easy, and doesn’t require complicated hardware. In just a few steps, you can start accepting secure contactless payments from cards, digital wallets, and smartwatches—giving your customers the convenience they expect and helping you speed up every transaction.

Contactless payment terminals

If you already use a countertop POS system, chances are your terminal supports NFC tap and pay technology. These terminals make it easy for customers to simply tap their card, phone, or smartwatch to complete a transaction in seconds.

- Fast, one-tap checkout experience for customers

- Works with contactless cards, phones, and smartwatches

- Reliable and secure with built-in encryption

Mobile readers

Need flexibility on the go? Mobile card readers are compact, wireless devices that connect to your smartphone or tablet via Bluetooth. They’re ideal for pop-up shops, delivery services, or events—allowing you to accept Tap to Pay transactions anywhere.

- Portable and lightweight for mobile businesses

- Quick setup—connects easily to your phone or tablet

- Same encryption and compliance as standard POS systems

Tap to Pay on iPhone

With Tap to Pay iPhone, your phone becomes the payment terminal—no extra hardware needed. Enable the feature through your payment provider POS app, and start accepting contactless payments directly on your device.

- No additional hardware required

- Perfect for mobile professionals, service providers, and vendors

- Integrated with your payment app for seamless tracking

Tap to Pay on Android

Android users can enjoy the same convenience with Tap to Pay on Android. Once activated through your payment app, your phone’s built-in NFC reader allows you to accept payments instantly from contactless cards or digital wallets.

- Turn your Android phone into a payment terminal

- Accept contactless cards, Google Pay, and other digital wallets

- Quick and secure setup via your payment app

Discover the power of Tap to Pay

Adding Tap to Pay to your checkout experience transforms how you handle transactions — delivering speed, security, and simplicity for both merchants and customers. Whether you’re running a busy retail counter, managing a service-based business, or processing payments on the go, the benefits are hard to ignore.

Never miss a sale

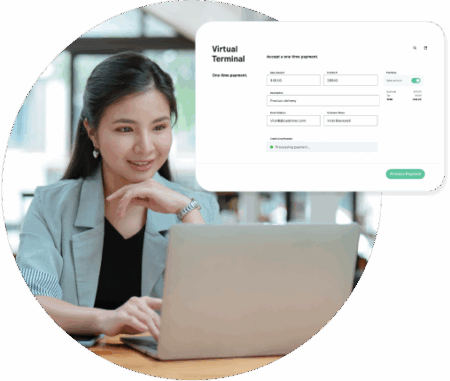

Accept phone orders safely

If your business accepts orders over the phone, a Tap to Pay terminal isn’t your only solution. Pair it with a virtual terminal to process payments securely, even when customers aren’t in front of you.

- Enter customer card details directly into a secure web-based portal.

- Accept payments remotely via phone or email.

- Keep all transactions PCI-compliant and fully encrypted.

- Manage payments alongside your Tap to Pay sales for a seamless experience.

This combination ensures you never miss a sale—whether in-person, on-the-go, or over the phone.

Pay for what you need and never what you don’t

POS hardware rentals can be expensive. That’s why our Payment Experts help you save on both POS software and equipment.

In most cases, our Payment Experts make sure your payment processor provides hardware free of charge, so you only pay for what your business actually needs.

Plus, with our Rate Sekurity Guarantee®, you can be confident you’re always getting the best possible deal—no surprises, no hidden costs.